One of the country’s main banks is increasingly investing in the Small Medium-sized Enterprises (SME) sector. BV intends to increase the volume of credit and also facilitate access to it through embedded finance.

To this end, the bank relies on CWI services to ensure that the group that covers 99% of national companies has quality and excellent banking assistance.

BV bank’s investment

BV Bank observed an opportunity for growth in the SME sector. Responsible for 99% of national companies, according to Sebrae, companies that are in this range demand banking services that can be provided by a private bank.

Using the concept of Embedded Finance, which concerns the construction of financial solutions within ecosystems that are not strictly financial, the bank uses the help of fintechs to increase its operations in the Brazilian market.

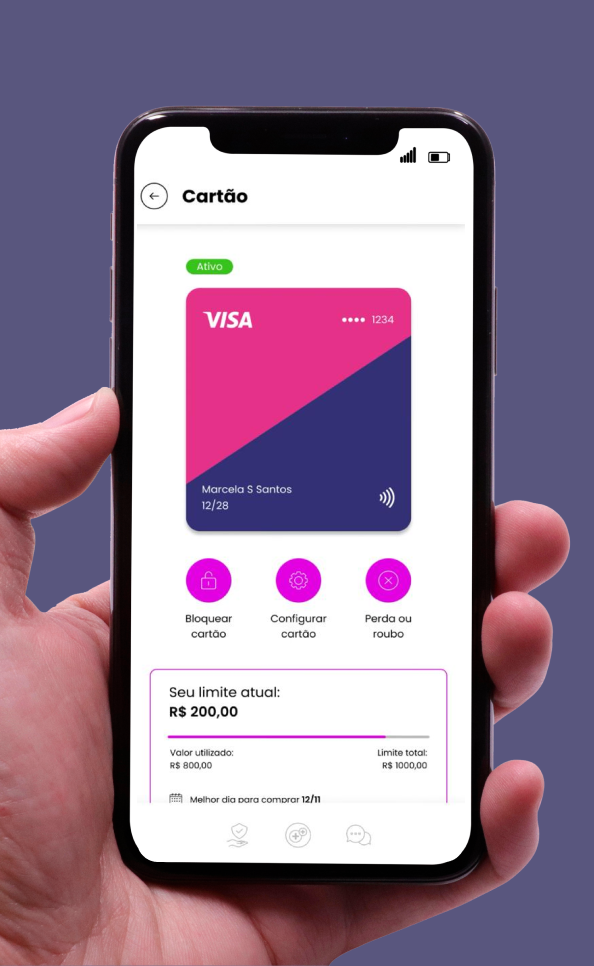

Offering some products suited to the reality of these companies, the bank stands out with three that represent importance, namely: business checks, loans and receivables.

To help sustain this entire operation involving a large volume of participants, such as companies and fintechs from all over Brazil, BV counts on the help of CWI.

Using the concept of Embedded Finance, which concerns the construction of financial solutions within ecosystems that are not strictly financial, the bank uses the help of fintechs to increase its operations in the Brazilian market.

Offering some products suited to the reality of these companies, the bank stands out with three that represent importance, namely: business checks, loans and receivables.

To help sustain this entire operation involving a large volume of participants, such as companies and fintechs from all over Brazil, BV counts on the help of CWI.

CWI’s performance at BV bank

The development team that works in front of the Corporate sector, responsible for initiatives with SMEs, is made up of professionals from CWI and also from BV, with the majority being cwiser developers.

Since 2021, CWI has operated on three main platforms in this sector: PLRC, which is responsible for accounts receivable financing issues; PLCA, which manages credit management and PLIQ, in charge of settlements.

The team is fundamental in the development and support of systems that bear the bank’s movements in relation to initiatives with SMEs. Platform modernizations were developed to meet the needs of increased volume, contributing to better growth results.

All the team’s effort and dedication result in the way CWI is seen within BV, becoming the main solution development partner in the SME sector.

Since 2021, CWI has operated on three main platforms in this sector: PLRC, which is responsible for accounts receivable financing issues; PLCA, which manages credit management and PLIQ, in charge of settlements.

The team is fundamental in the development and support of systems that bear the bank’s movements in relation to initiatives with SMEs. Platform modernizations were developed to meet the needs of increased volume, contributing to better growth results.

All the team’s effort and dedication result in the way CWI is seen within BV, becoming the main solution development partner in the SME sector.

Challenges encountered

- During BV bank’s continuous movement of growth and innovation, CWI encountered some challenges that were successfully overcome.

- The team, made up of diverse professionals, is responsible for delivering relevant technical capacity that can bring distributed and scalable solutions.

- With the increase in the volume of participants in the initiative, such as fintechs and companies, the team faced the challenge of standardizing the system, offering a single system that could communicate with any partner.

Banco BV, like other clients in the financial segment, trusts CWI teams to find solutions to their challenges. Check out more of our solutions and partnerships!